The Fear of Medical Debt

In the United States, millions of uninsured individuals live with the constant fear of seeking medical care due to the daunting costs associated with it. The financial burden of hospital bills can be overwhelming, leading many to either enter into lengthy payment plans or forgo necessary treatment altogether. This dilemma highlights the harsh reality faced by those without insurance, where the cost of care becomes a significant barrier to health and well-being.

Negotiating Hospital Bills: A Expert’s Perspective

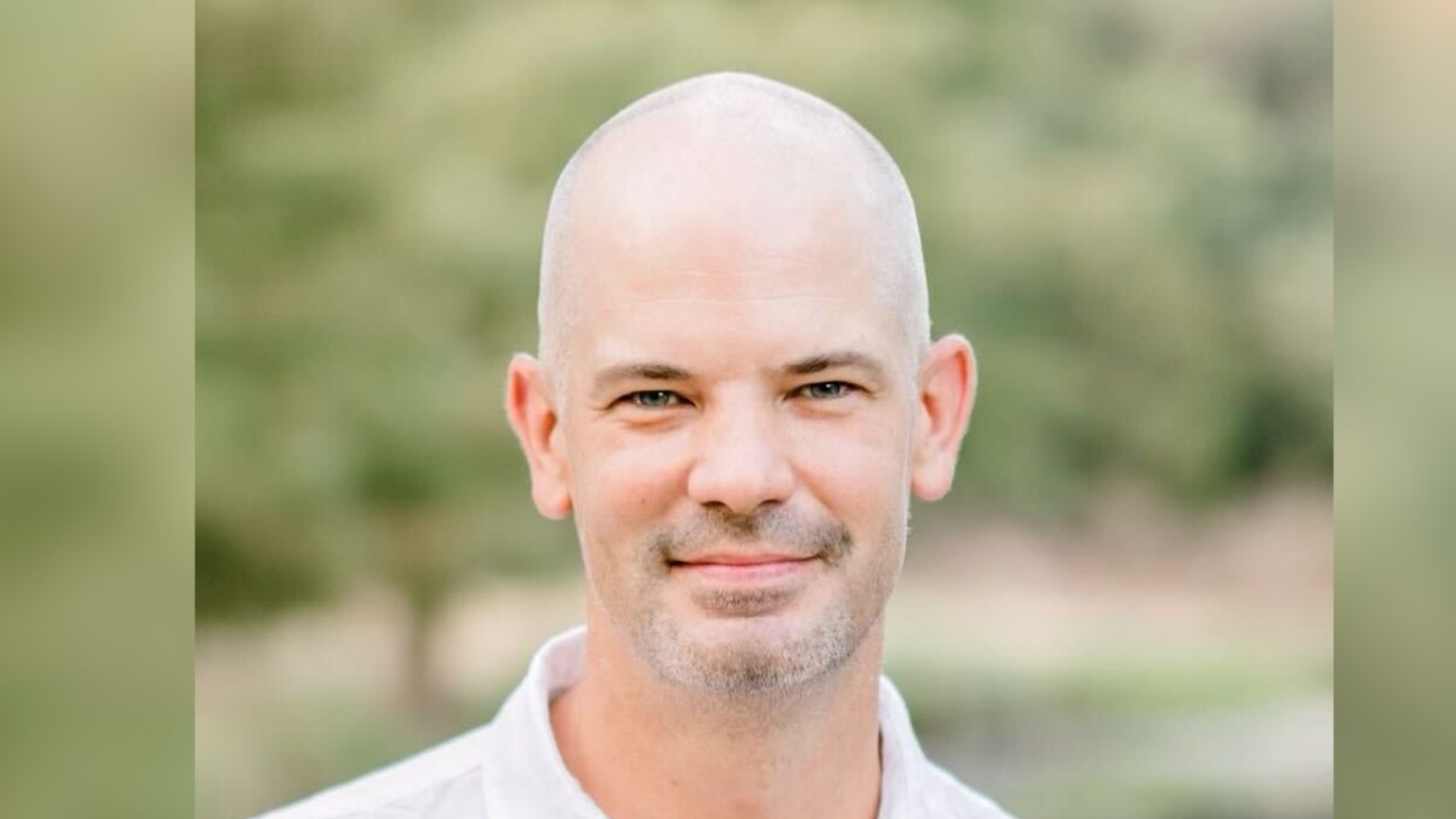

Andy Schoonover, CEO of CrowdHealth, offers a beacon of hope for those struggling with medical debt. His personal experience of receiving a $20,000 bill for an IV drip he purchased for just $8 on Amazon underscores the absurdity of medical billing. Schoonover ignored the bill, which was sent to collections, without any adverse effect on his credit score. This experience led him to advocate for patients’ rights, emphasizing that individuals have more power to negotiate their bills than they realize. He advises checking billing codes for errors and leveraging the willingness of hospitals to accept lower payments to avoid total loss.

Lack of Transparency in Medical Billing

One of the most significant issues in the medical billing system is its opacity. Patients are often unaware of the costs upfront, making it difficult to make informed decisions. Schoonover compares this lack of transparency to price gouging during emergencies, where individuals are forced to make life-or-death decisions without the ability to negotiate. This coercive environment leaves patients vulnerable, unable to seek alternative care due to the urgency of their situation.

The Role of Traditional Insurers

Traditional health insurers are not without fault in this crisis. They often leave policyholders with unexpected out-of-pocket expenses and high deductibles, which can quickly escalate into unmanageable debt. This debt, when reported to credit agencies, further entrenches financial hardship, making recovery even more challenging. Schoonover criticizes the system for its lack of transparency and accountability, arguing that it operates more like a monopoly than a competitive free market.

The Impact of Medical Debt

The consequences of medical debt are far-reaching. With over 46 million Americans having medical debt on their credit reports in 2020, the financial burden is immense. This debt can hinder credit scores, limit financial opportunities, and exacerbate stress, which in turn can worsen health conditions. The fear of bankruptcy due to a major health event is a reality for many, highlighting the urgent need for systemic change.

Innovative Solutions to Medical Debt

CrowdHealth, founded by Schoonover, offers an innovative approach to addressing medical debt. By providing an alternative to traditional insurance, the platform assists individuals in finding affordable care, negotiating bills, and funding costs through a peer-to-peer model. This approach has already saved users over $29 million, demonstrating the potential for community-driven solutions to alleviate the burden of medical expenses. While regulatory reforms are pending, initiatives like CrowdHealth provide hope for those navigating the complex and often unfair medical billing system.