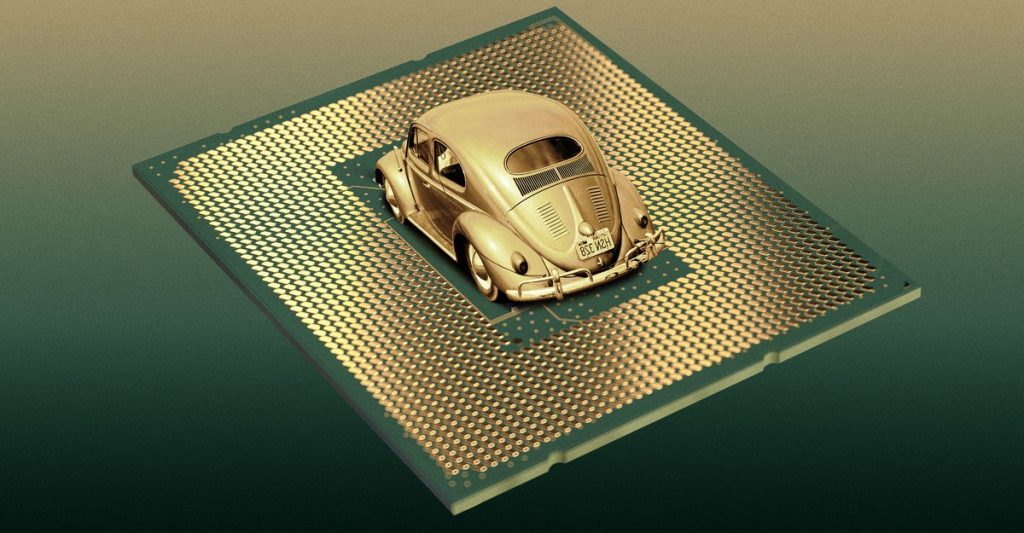

The Electric Revolution: How Volkswagen’s Rivian Deal Signals a Shift in Automotive Manufacturing

The automotive industry is in the midst of a revolution, and electric vehicles (EVs) are at the heart of it. For decades, cars and trucks have been synonymous with internal combustion engines (ICEs), but the shift to electric motors has turned the traditional manufacturing model on its head. The recent announcement of Volkswagen’s multibillion-dollar joint venture with Rivian, a startup EV maker, is a telling sign of how dramatically the landscape has changed. This deal isn’t just about two companies working together; it’s about a legacy automaker acknowledging its struggles and seeking outside help to stay competitive in the EV era.

The Deal: A Billion-Dollar Bet on Software

At first glance, the partnership between Volkswagen and Rivian looks like a lopsided arrangement. Volkswagen is committing $1 billion upfront, another $1 billion for the joint venture, and up to $2 billion more if certain goals are met, plus a $1 billion loan to Rivian. In return, Rivian isn’t contributing any cash—only its software expertise and intellectual property. For Rivian, this is a lifeline. The company, despite producing popular and highly reviewed EVs like its SUV and pickup truck, is losing money on every vehicle it sells—over $38,000 per car. The influx of capital from Volkswagen will help Rivian scale its operations and improve its financial stability.

But the real winner here might be Volkswagen. The German automaker isn’t just investing in Rivian; it’s buying its way into the software expertise it so desperately needs. When Volkswagen launched its ID.3 electric sedan, the vehicle’s software was plagued by glitches. The touchscreen was unreliable, the traffic-detection system was erratic, and wireless software updates were inconsistent. These issues delayed the release of other models like the ID.4 and even caused recalls. Meanwhile, Tesla has been seamlessly updating its vehicles’ software over the air for years. Volkswagen’s struggles highlight a harsh reality: making reliable EV software is just as important as building the vehicles themselves.

Volkswagen’s Struggles with Software-Defined Vehicles

Volkswagen’s challenges with EV software are surprising, given how early and aggressively it entered the electric vehicle market. The company invested billions in manufacturing plants, charging stations, and even an in-house software development arm called Cariad, which aimed to employ 10,000 digital experts. Industry analysts were optimistic, predicting that Volkswagen would overtake Tesla as the world’s largest EV manufacturer by 2024. But those predictions haven’t come to fruition. Today, Volkswagen is the fourth-largest EV maker globally, trailing Tesla and Chinese companies like BYD and SAIC.

The company’s struggles stem from challenges inherent to legacy automakers. While Volkswagen has poured resources into EVs, it still produces millions of gas-powered cars every year. This creates a conflict of interests, as the company’s established businesses have little incentive to cede ground to electric vehicles. Additionally, Volkswagen’s expertise lies in hardware—manufacturing physical vehicles—not in software. Building software-defined vehicles, like those made by Tesla and Rivian, requires seamless integration of hardware and software from the start. Volkswagen has found this difficult to achieve, leading to delays, recalls, and frustrated customers.

The Bigger Picture: Legacy Automakers in the EV Era

Volkswagen isn’t alone in its struggles. Many legacy automakers have found it difficult to adapt to the EV era. Companies like Ford and Hyundai have had some success with models like the F-150 Lightning and the Ioniq, but these successes are exceptions rather than the rule. The defining companies of the EV market—Tesla, BYD, and Rivian—have one thing in common: they are not bogged down by legacy businesses. They focus exclusively on electric vehicles and have built their operations around software-driven, connected cars.

For legacy automakers, the transition is more complicated. They must navigate bureaucratic structures, balance competing interests, and acquire new expertise. Volkswagen’s partnership with Rivian represents an acknowledgment of these challenges. By leveraging Rivian’s software capabilities, Volkswagen hopes to solve one of its biggest problems: creating reliable, user-friendly software for its EVs. If successful, the deal could revitalise Volkswagen’s electric ambitions and position it as a major player in the EV market.

The Future of Automotive Manufacturing: Can Volkswagen Succeed?

While some might dismiss Volkswagen’s Rivian deal as another false start, it would be a mistake to underestimate the potential benefits. Volkswagen still has immense expertise in vehicle manufacturing, and that matters. Even Tesla, the EV pioneer, faced significant challenges when scaling production of its Model 3 in 2018—a period Elon Musk infamously referred to as “production hell.” If Volkswagen can combine its manufacturing prowess with Rivian’s software capabilities, it could finally realise its electric vision.

The deal also reflects a broader shift in the automotive industry. Cars are no longer just hardware; they are software-defined products, and the companies that master this duality will dominate the future. Legacy automakers like Volkswagen must decide whether to go it alone or partner with newer, more agile companies like Rivian. For Volkswagen, the choice is clear: if you can’t beat them, join them.

In the end, the Volkswagen-Rivian partnership is more than just a business deal—it’s a statement about the state of the automotive industry. The rise of electric vehicles has shaken the foundations of car manufacturing, and companies must adapt to survive. For Volkswagen, this deal is a step in the right direction, one that could help it regain ground in the EV race. But the road ahead won’t be easy, and success will depend on how well Volkswagen can integrate Rivian’s software expertise into its operations. If it succeeds, the partnership could become a blueprint for other legacy automakers navigating the electric revolution.