Inflation Eases More Than Expected in February

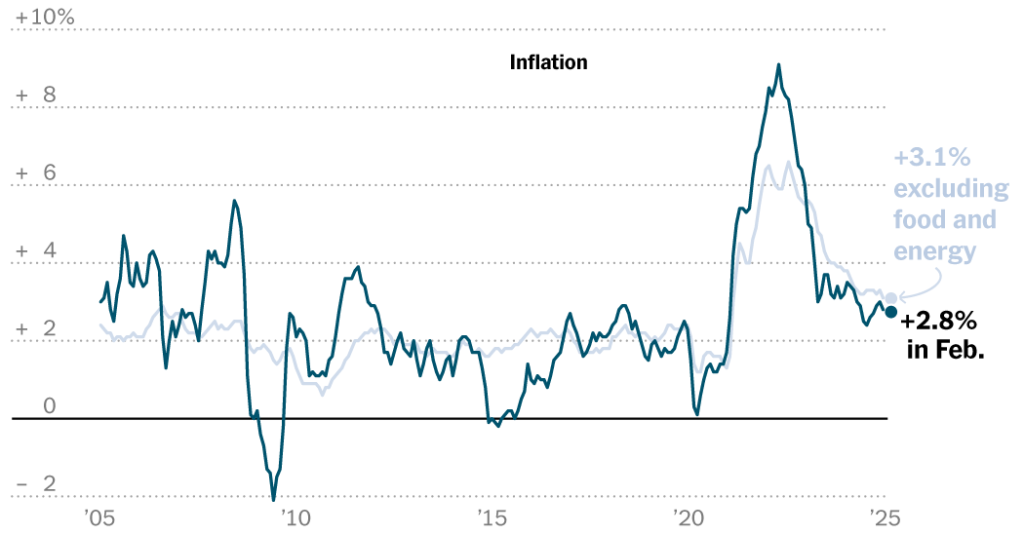

Inflation in the United States showed signs of slowing down in February, bringing some relief to the Federal Reserve as it navigates the challenges of rising prices and slower economic growth, partly exacerbated by President Trump’s trade policies. The Consumer Price Index (CPI), a key measure of inflation, rose by 2.8% compared to the previous year, marking a slight decline from January’s 0.5% monthly increase. On a monthly basis, CPI increased by 0.2%, which was below economists’ expectations. This moderation in inflation could provide the Fed with a degree of comfort as it continues to monitor the impact of trade tensions and other economic factors.

Core Inflation Shows a Similar Trend

The “core” CPI, which excludes volatile food and energy prices, also reflected a cooling trend. It rose by 0.2% in February compared to the previous month and 3.1% year-over-year, both of which were lower than the increases observed in January. While this suggests that underlying inflation pressures may be stabilizing, the data also highlighted the uneven nature of price movements across different categories. For instance, while prices for essentials like eggs and groceries continued to rise sharply, other categories such as gasoline and airfares saw declines. A 4% drop in airfares during the month was a key contributor to the better-than-expected inflation data.

Food and Other Consumer Staples Drive Price Increases

The Bureau of Labor Statistics reported that egg prices surged by 10.4% in February, driven by a nationwide shortage caused by an avian influenza outbreak. Over the past year, egg prices have skyrocketed by nearly 60%. More broadly, food prices increased by 0.2% in February and 2.8% year-over-year, underscoring the persistent pressure on household budgets. Meanwhile, the cost of used cars rose by 0.9%, though new vehicle prices dipped slightly. Car insurance, which had been a major driver of January’s CPI increase, continued to rise but at a slower pace of 0.3%. Over the past year, car insurance costs have climbed by over 11%.

Housing Costs Show Modest Growth

Housing-related expenses, which make up a significant portion of the CPI, recorded their smallest 12-month increase since December 2021. The shelter index rose by 4.2% year-over-year and 0.3% on a monthly basis. While this indicates some moderation in housing costs, it remains a key driver of inflation. The combination of rising food, insurance, and housing expenses highlights the delicate balance the Fed must strike in its efforts to keep inflation in check while supporting economic growth.

The Impact of Trump’s Tariffs on Consumer Prices

A critical question looming over the economic landscape is how President Trump’s tariffs will affect consumer prices in the coming months. During the period covered by February’s CPI data, only the initial 10% tariffs on Chinese imports were in place. According to Ryan Sweet, chief U.S. economist at Oxford Economics, these tariffs had no discernible impact on CPI in February, including for apparel, furniture, and electronics. However, with the tariffs on Chinese goods recently doubled and additional tariffs being implemented, their effects are expected to become more apparent in the near future. Peter Tchir, head of macro strategy at Academy Securities, warned that reciprocal tariffs on U.S. trading partners could further drive up costs for imported goods.

Economic Uncertainty and the Fed’s Policy Path Ahead

The uncertain trajectory of President Trump’s trade and economic policies has heightened concerns about the outlook for the U.S. economy. Slower growth and resurgent inflation pressures place the Fed in a challenging position as it seeks to fulfill its dual mandate of maintaining low, stable inflation and a healthy labor market. While the Fed has paused its interest rate cuts for now, traders in futures markets are betting on three rate cuts later in the year, reflecting growing anxiety about the economic outlook. Jerome H. Powell, the Fed chair, emphasized the importance of separating “signal from noise” as the central bank continues to monitor the evolving economic landscape. For now, the Fed appears well-positioned to maintain its cautious pause on rate cuts.

In summary, February’s inflation data provided some reassurance that price pressures may be stabilizing, but the ongoing trade tensions and policy uncertainties pose significant risks to the economic outlook. As the Fed navigates this complex environment, its decisions will be closely watched by markets and consumers alike.