The Impact of Tariffs on the Automotive Industry: A Complex Web of Trade and Production

The automotive industry is bracing for significant disruption as the Trump administration’s proposed 25% tariffs on goods from Canada and Mexico threaten to upend decades of carefully constructed supply chains. Since the establishment of the North American Free Trade Agreement (NAFTA) in 1994, automakers have built intricate networks that rely on cross-border trade to optimize efficiency and reduce costs. Today, millions of vehicles and parts flow across U.S. borders daily, making the region one of the most interconnected automotive manufacturing hubs in the world. However, the imposition of tariffs could have far-reaching consequences, not only for automakers but also for consumers who may face higher prices and reduced affordability of vehicles.

The Global Supply Chain: A Delicate Balance of Efficiency and Complexity

The automotive supply chain is a testament to the power of globalization. Automakers have invested heavily in creating economies of scale by building large assembly plants, engine factories, and transmission facilities that serve multiple vehicle factories across North America. For example, a single engine plant in the United States might supply several assembly lines in Mexico or Canada. Similarly, components like seats, instrument panels, and electronics are produced in locations that leverage each country’s strengths, ensuring cost-efficiency and quality. This interconnected system allows automakers to keep costs low and pass the savings on to consumers. However, this complexity also means that it is increasingly difficult to determine whether a vehicle is truly “American-made” or imported, as nearly all modern vehicles rely on parts from multiple countries.

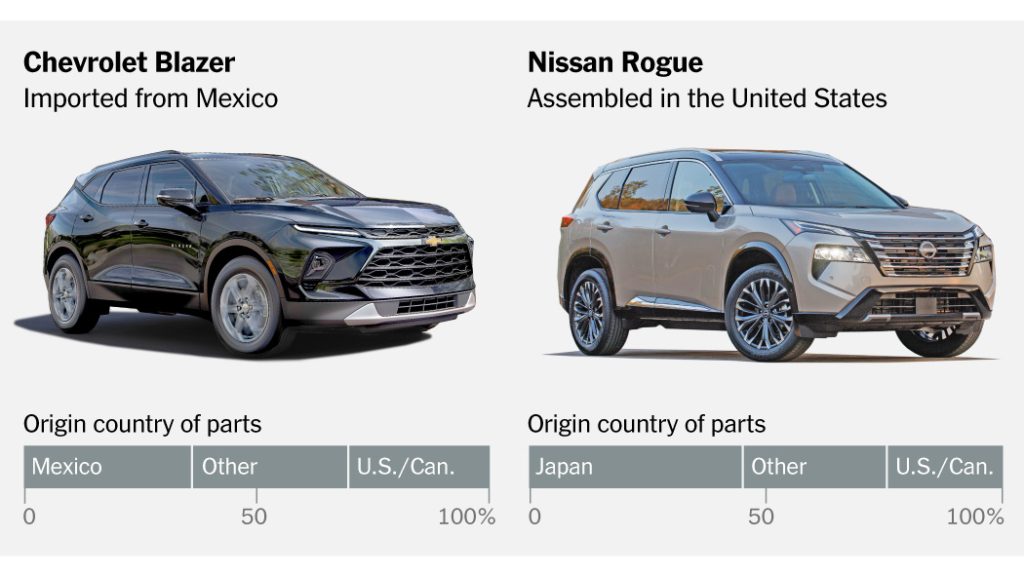

The Blurred Lines of Vehicle Origin: A Tale of Parts and Assembly

The concept of a vehicle’s “origin” has become increasingly murky in the modern automotive industry. A vehicle is generally considered an import if it is assembled in another country before being shipped to the United States. However, the reality is far more nuanced. For instance, the 2024 Chevrolet Blazer, a popular SUV made by General Motors, is assembled in Mexico using engines and transmissions produced in the United States. Similarly, the Nissan Altima, assembled in Tennessee and Mississippi, features a Japanese-made engine and a Canadian-made transmission. Even vehicles like the Toyota RAV4, which are assembled in Canada, rely heavily on U.S.-made components. This interconnectedness highlights the challenges of applying tariffs to individual components, as many parts cross the border multiple times during the production process.

The Threat of Tariffs: A Potential Blow to the U.S. Automotive Industry

The Trump administration’s proposed tariffs have sent shockwaves through the automotive industry, with many executives warning of dire consequences. Jim Farley, CEO of Ford Motor, has stated that a 25% tariff on imports from Mexico and Canada would “blow a hole in the U.S. industry that we’ve never seen.” John Elkann, chairman of Stellantis, which owns brands like Chrysler and Jeep, has expressed support for promoting American manufacturing but has also emphasized the importance of maintaining tariff-free trade with Mexico and Canada. The threat of tariffs has left automakers scrambling to assess the potential impact on their supply chains and pricing strategies.

The Consumer Perspective: Affordability and Indifference to Origin

While automakers are deeply concerned about the impact of tariffs, many consumers seem less worried about where their vehicles are made. For most car buyers, factors like price, reliability, and features are far more important than the country of origin. Frank Krieber, a retired tech executive from Charlotte, North Carolina, exemplifies this attitude. He recently purchased a Chevrolet Tahoe, assuming it was an American-made vehicle because it is assembled in Arlington, Texas. However, according to the National Highway Traffic Safety Administration, only about 35% of the vehicle’s parts are made in the United States, with a similar percentage coming from Mexico. Despite this, Krieber expressed indifference to the Mexican content, stating that he would have purchased the vehicle even if it had been assembled in Mexico instead of Texas.

The Bigger Picture: The Evolution of Automotive Production and Trade

Over the past three decades, the automotive industry has undergone significant changes, driven by the integration of North American markets under NAFTA and the increasing globalization of supply chains. While the number of vehicles imported to the United States has remained relatively stable over the past 20 years, the number of vehicles produced domestically has fluctuated, influenced by events like the 2008-2009 financial crisis and the COVID-19 pandemic. Mexico has emerged as the largest source of imported vehicles, followed by Japan, South Korea, and Canada. Despite these shifts, the reliance on international trade remains a cornerstone of the automotive industry, ensuring that vehicles remain affordable and accessible to consumers across the United States.